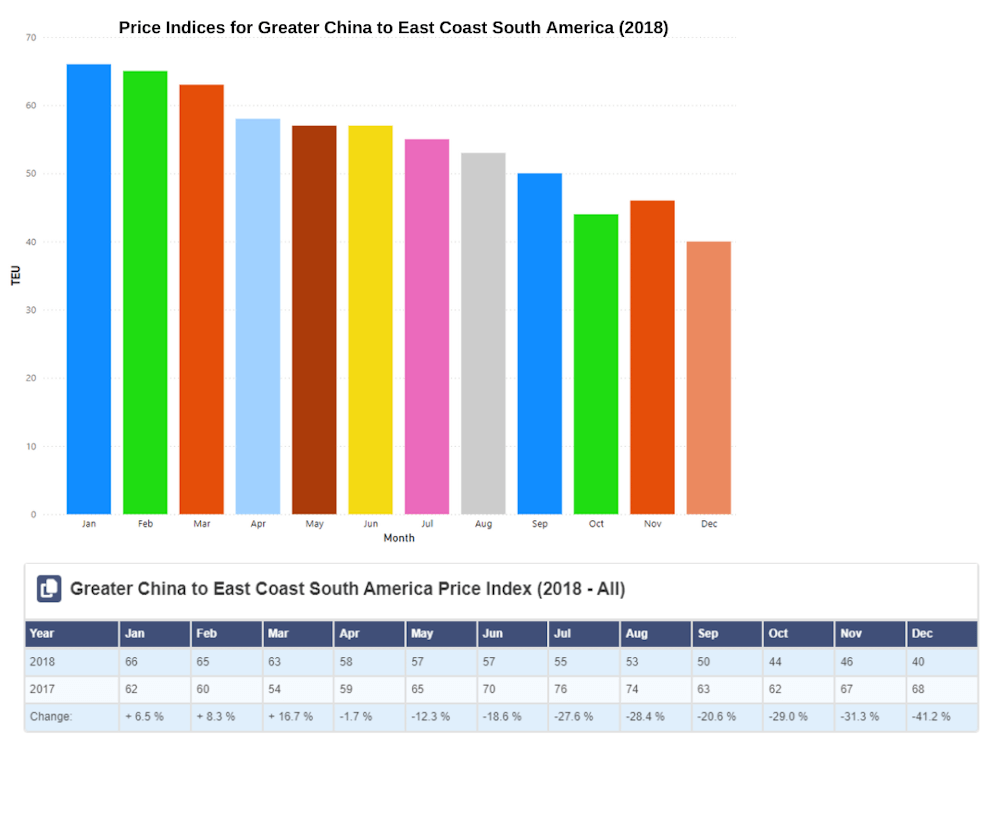

Price Indices

Why should shippers remain in the dark about freight trends when transparency would drive better decision-making?

Trusted by industry professionals worldwide, the CTS price indices offer valuable insights into pricing dynamics. They can help you make informed decisions and adapt your strategies accordingly.

The CTS price indices are generated monthly based on the actual sea freight rate data in the shipping line’s manifest. They are published with a one-month time lag and come as standard at regional and sub-regional levels*. Available at Dry, Reefer or Combined (ALL) cargo type.

The flagship Far East to and from Europe trade is derived from 100% contributed data, reflecting CTS’s commitment to accuracy and reliability.

- Reports available for purchase as a one-off dataset or through an ongoing subscription.

- Subscriptions sold in 12-month blocks with the previous 12 months of data provided for free.

- Each account accommodates up to five independent users.

Why should shippers remain in the dark about freight trends when transparency could drive better decision-making?

Trusted by industry professionals worldwide, the CTS price indices offer valuable insights into pricing dynamics. They can help you make informed decisions and adapt your strategies accordingly.

The CTS price indices are generated monthly based on the actual sea freight rate data in the shipping line’s manifest. They are published with a one-month time lag and come as standard at regional and sub-regional levels*. Available at Dry, Reefer or Combined (All) cargo type.

The flagship Far East to and from Europe trade is derived from 100% contributed data, reflecting CTS’s commitment to accuracy and reliability.

- Reports available for purchase as a one-off dataset or through an ongoing subscription.

- Subscriptions sold in 12-month blocks with the previous 12 months of data provided for free.

- Each account accommodates up to five independent users.

Power BI reports available upon request during data purchase.

The CTS Price Indices include all associated costs with shipping a Twenty-foot Equivalent Unit (TEU) quay to quay:

- Hazardous Cargo Additional

- Congestion Surcharge

- Currency Adjustment Factor (CAF)

- Bunker Adjustment Factor (BAF) – including Low Sulphur Fuel Additional

- Terminal Handling Charge (Origin and Destination)

- EU Emissions Trading System (ETS) surcharge

- Any other charge relating to the sea leg

- Basic Ocean rate from lines’ B/L port of loading to B/L port of discharge including feeders Special Equipment Additional

* Bespoke price indices are available at country and port level upon request, to find out more get in touch today.

Enquiry Form

“Japan Maritime Centre (JMC) is a representative think tank on shipping in Japan and uses CTS data to compile and analyse container transport trends. The analysis conducted has been published not only in the form of policy recommendations and surveys for businesses, but also in general newspaper articles and academic papers. CTS data has become a valuable and integral part of today’s researched by JMC.”

Looking for more granular data? Explore our TEU Volumes or CTS Newsletter to unlock deeper insights now!

All figures are published monthly with a one-month time lag. CTS does not count transhipments or empty boxes

Contact Us:

+44 1483 77 88 50

sales@containertradesstatistics.com

Container Trades Statistics Ltd

One Crown Square

Church Street East

Woking

GU21 6HR

UK